FLOOR COVERING EDUCATION FOUNDATION (FCEF)

TRACKER

MEET THE FCEF

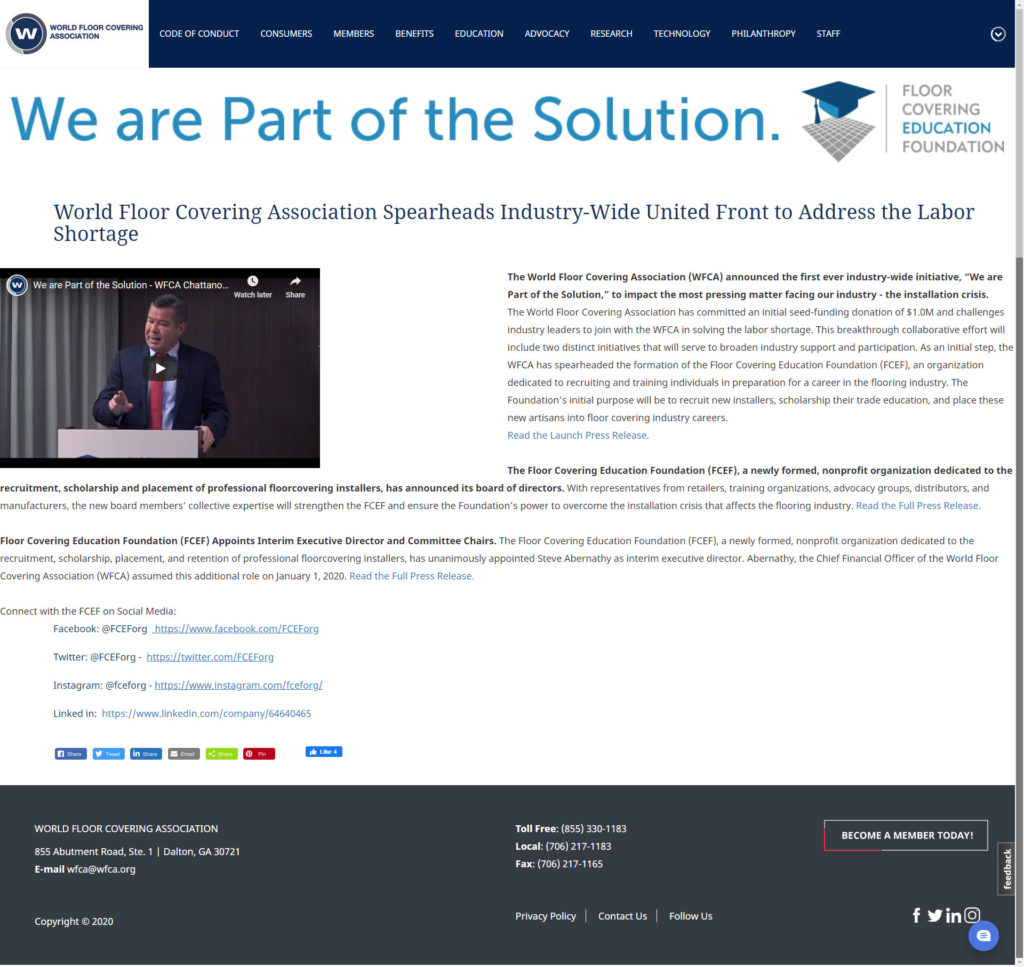

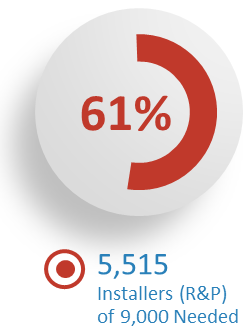

The World Floor Covering Association (WFCA) and its leadership have adopted a new flooring industry initiative by creating a non-profit organization named the Floor Covering Education Foundation (FCEF) to solve the pending "Installer Crisis". A crisis losing 3k to 6K installers a year.

The FCEF solution:

Installer Crisis Progression

The Number of Installers Lost Since the FCEF Infancy in December 2019

PainPoints Presents: Is the FCEF a Bust? Series! Watch All 4 Episodes Now!

Projected FCEF Model Solutions

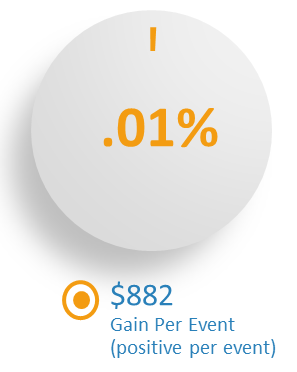

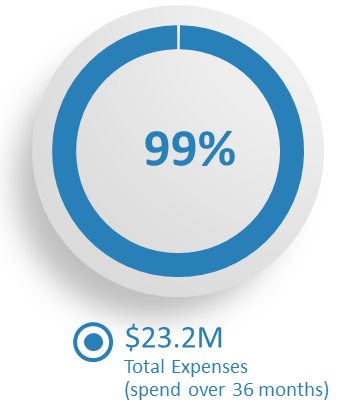

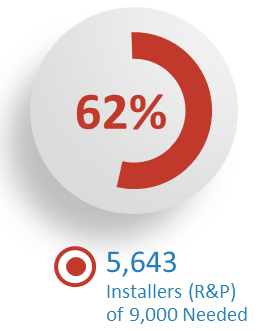

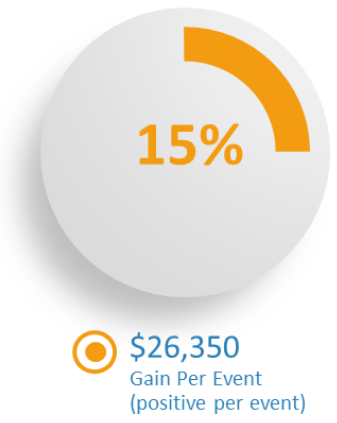

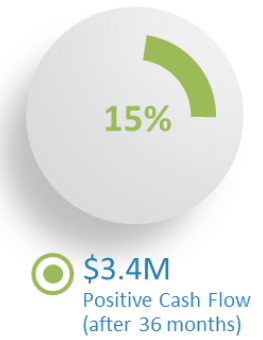

The below graphs and data are projected results

Number of Installers

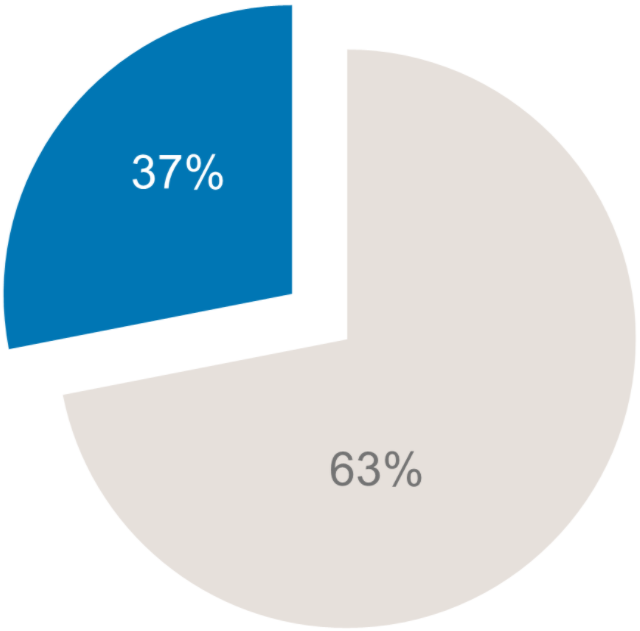

Gain vs Loss

FCEF Supporting Installers (Recruits) Solutions

Other Solution?

If the Floor Covering Education Foundation is supporting dealers during the program, how is the FCEF supporting Recruits? Some Suggestions:

Other Solution?

Can the Floor Covering Education Foundation offer discounts to installers to enhance their training, growth and professionalism?

Other Solution?

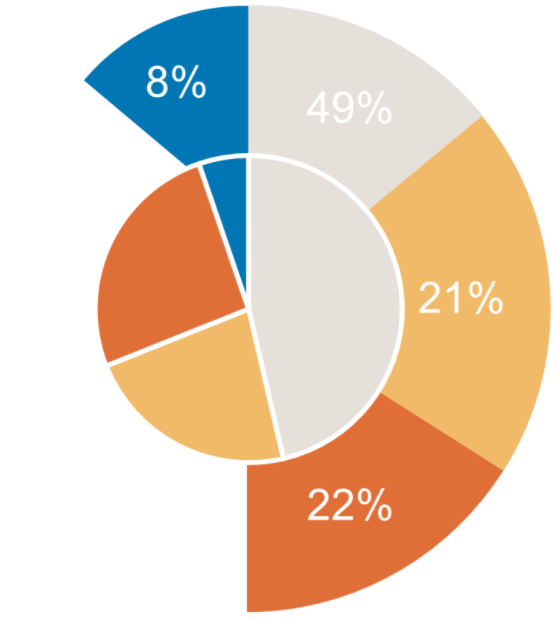

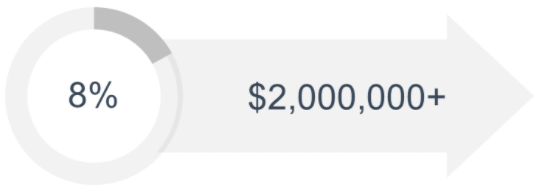

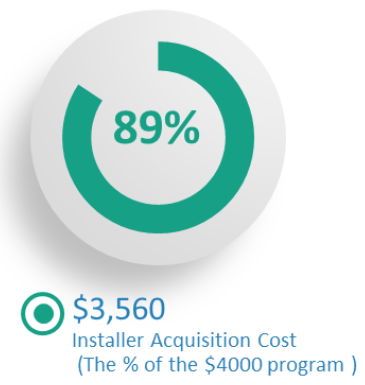

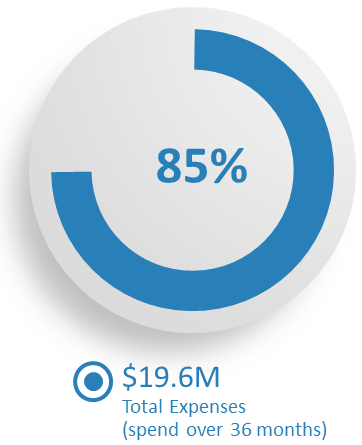

FCEF's Major Expenses

Broken down into 4 Categories

Scholarships

$2,000 given to each qualified Recruit.

Running Cost

Trucking staff, truck cost, maint., fuel, 30k miles, etc.

Foregiveness Loans

$1,000 returned to Recruit after completion.

Other Expenses

Purchase of Tractor, trailer, marketing, etc.

Largest expense, 1/2 of all expenses. This may increase or decline based on the number of Recruits in the program annually.

This includes 2 trucks, and cost of running the trucks. This doesn't include other employee costs, event costs, etc.

This expense is attributed to retaining 1,833 Recruits/yr. Assuming all 1,833 full fill their program obligations.

Truck and trailer cost are one-time purchases and a depreciating metric. Marketing is 2% of revenue and low to make projections work for a 2 truck model.

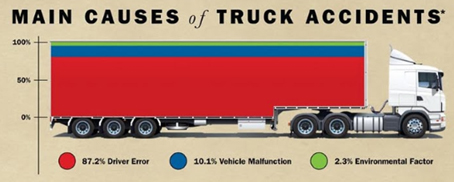

Semi-Truck Obstacles & Solutions

Other Solution?

14-hour clock, 8-2 Splits, 10 hours Off-Duty:

Other Solution?

Revenue as a Sustainable Solution for Success

As long as Contributions are Constant - Installer Win!

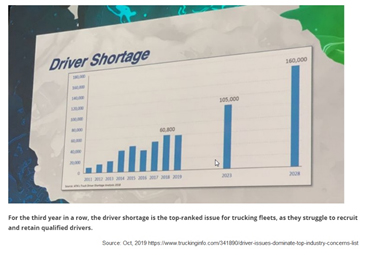

Trucking Industry has a Driver Shortage Crisis Too?

Other Solution?

Floor Covering Education Foundation Classroom is Out of Service Solutions

Other Solution?

FCEF's Story

In Almost One Year, with no Updates.

Where are the FCEF Solutions?

Installers are waiting to Believe.

FCEF Official Website from the WFCA

Note: We tried using an <iframe> code so you could see Live updates, but the WFCA rejected the connection. As you can see there's not much to it. It's only one page deep with not very much information provided.

Most Frequently Asked Questions

Does TilingMyWay want the FCEF to Succeed?

Of course! Bringing in new talent during good and bad times will always be a concern in the industry. And the time couldn't be better!

Many changes are on the horizon for all professional in our great industry. And no time is more important than now to get involved in helping all organizations to understand "You". This especially includes the FCEF.

The more the FCEF understands how they are meeting industry needs, the better it is for all of us. The FCEF's success is TilingMyWay's success and why we are pressing the FCEF in how they spend theirs and others time and money, as efficiently as possible.

The "Installer Problem" is an important one and we are here to see the FCEF prevail, even if that means changing their minds for success.

Why should I Vote YES on the FCEF?

Great question, because their success and failure will affect you.

We referenced the Oxford Dictionary the following definition for the word "Crisis", "A time when a difficult or important decision must be made."

The FCEF is building dreams, in that their decisions provide "solutions" to our pending "Installer Crisis". Solutions that we find are too slow, too costly for very little industry benefit.

More importantly, when those dreams turn into nightmares, other people pay for it. Installers (new and current) deserve better!

Vote YES to keep Scott Humphrey and the FCEF Board of Directors accountable in providing adequate solutions.

Want to learn more about the FCEF?

So do we 🙂 This website provides all the latest news and postings from the FCEF and as you can see it's not much. Demand more by emailing Scott Humphrey and request that he gives everyone an update immediately!

© 2020 FCEF Tracker All Rights Reserved

The views expressed here are those of the individual BuildMyWay

personnel quoted and are not the views of its affiliates. Certain information

contained in here has been obtained from third-party sources, including from individuals

who were paid or volunteered to express their opinions. While taken from sources believed to be

reliable, BuildMyWay has not independently verified such information and makes

no representations about the enduring accuracy of the information or its

appropriateness for a given situation. In addition, this content does not

include third-party advertisements; BuildMyWay has not reviewed such

advertisements and does not endorse any advertising content or individual

contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own professionals as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute a recommendation or offer to provide advisory services. Furthermore, this content is not directed at nor intended for use by any investors/contibutor or prospective investors, and may not under any circumstances be relied upon when making a decision to invest/fund for BuildMyWay or said company/organization. (An offering to invest in a BuildMyWay fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed or affiliated with BuildMyWay, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results.

Charts, graphs, images and text provided within are for informational purposes solely and should not be relied upon when making any investment or supporting decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.